Notice this method produces a different inventory turnover ratio. Let’s continue with The Home Depot example, using $14.5 billion in average inventory and approximately $72.7 billion for the cost of goods sold. This typically provides a more accurate view of inventory turnover because it excludes any markup. A second method is to divide the cost of goods sold by the average inventory for the time frame in view.

This method is generally a little optimistic since it includes the company’s profit when it takes total sales as its numerator.ĬOGS and average inventory. Using this method, we would estimate that The Home Depot turns its inventory about once every 48 days.

If we wanted to know home many days it takes The Home Depot to turn its inventory once, we could divide the number of days in the year by the inventory turnover ratio we just calculated. Home Depot turns over its inventory about 7.6 times each year. Using this method we could calculate Home Depot’s inventory turnover ratio as 7.6. We can calculate inventory turnover for a single public company (such as The Home Depot) and estimate the average turnover for an entire industry. Sales ÷ Ending Inventoryįor example, for the fiscal year ended January 31, 2020, The Home Depot reported total revenue of $110.2 billion, a cost of revenue (roughly the cost of goods sold) of $72.7 billion, and an inventory balance of $14.5 billion (which I will use as a stand-in for both ending inventory and average inventory), according to Yahoo! Finance. Many investors use a company’s sales and its ending inventory to calculate its inventory turnover ratio. The method you choose depends on which provides a better view of your company’s inventory and sales performance. The calculations produce different results. There are at least a couple of ways to calculate an inventory turnover ratio: (i) total sales divided by ending inventory or (ii) cost of goods sold divided by average inventory. Thus, inventory turnover - and the related inventory turnover ratio - is a powerful key performance indicator. The company with 10 inventory turns should experience better cash flow and more sales. But one company turns its inventory 10 times each year and the other only five times. Both companies hold about $1 million in inventory on average.

:max_bytes(150000):strip_icc()/latex_9418d2dc3ff529146c36a79e2640b1a2-5c561ba646e0fb00013fb6c4.jpg)

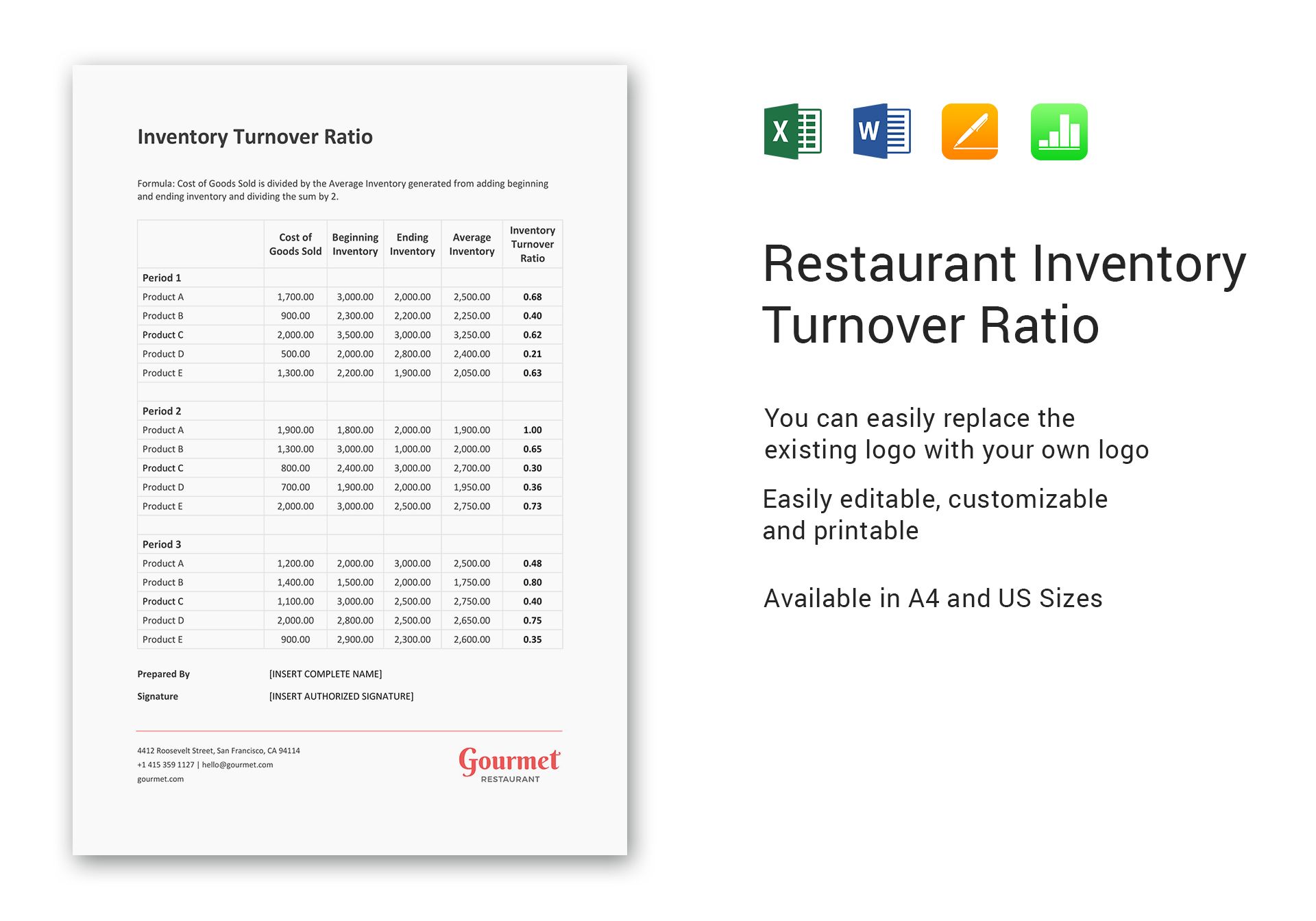

Imagine two online retailers selling products for home gardeners. Note: The COGS amount is found on the Income Statement and the Inventory Value on the Balance Sheet.How quickly a business sells its inventory is typically a strong indicator of efficiency, cash flow, and general well-being. Inventory turnover ratio = (Cost of Goods Sold) / ((Beginning Inventory Value + Ending Inventory Value) / 2) Each type of industry will have different benchmarks and norms. Generally speaking, a higher Inventory Turnover rate is better, while a lower Inventory Turnover rate suggests inefficiency and difficulty turning stock into revenue. It is also a critical tool when selling perishable goods, where the potential for waste is high. Inventory Turnover is an important efficiency metric and is helpful in analyzing pricing, product demand, and, of course, inventory purchase and costs. The Inventory Turnover is a KPI that measures how often, in a given time-period, your organization is able to sell its entire inventory.

0 kommentar(er)

0 kommentar(er)